How to Value Your Equity at an Early Stage Startup

Considering joining an early-stage startup? Most employees hope to join a rocketship and being offered equity at an early-stage can sound tempting. But how do you know what value to assign to the shares of equity you’ve been offered—what is your percentage really worth? In public companies or late-stage startups, assigning an approximate monetary value to equity shares is more straightforward and reasonably accurate. But at an early-stage startup, ascertaining the value of equity is far more nebulous. How can you decide between accepting a position from an established company at a higher salary—but with no equity—and joining a startup with less stability and a lower salary plus equity shares?

3 Factors Help You Determine the Value of Your Equity

- Dilution—How Investment Affects Your Share

- Probability—of Success and Failure

- Time to Reach an Exit Event

Chris Stanton, HBS professor and expert in entrepreneurial management, analyzed data gathered by Sand Hill Econometricson on over 10,000 venture-backed firms. After reviewing data and interviewing VCs and entrepreneurs, he and Shikhar Ghosh devised a framework to help you assign a value to equity shares as an employee at an early-stage startup.

In a working session captured on video, Stanton reviews three interrelated factors that affect the value of your equity—dilution, probability, and time.

Averaging data, Stanton’s research suggests that most equity offers from early-stage startups end up being worth roughly 10% of the initial grant.

Curious how he arrived at those results? Stanton reveals details about his conclusions and shares how you can apply the framework to your own situation.

Dilution—How Investment Affects Your Share

Dilution—How Investment Affects Your Share

Suppose that you have an offer to join a startup with the founder at the pre-seed stage—before any money is raised—for a 10% share of the startup’s equity. What does 10% look like over time?

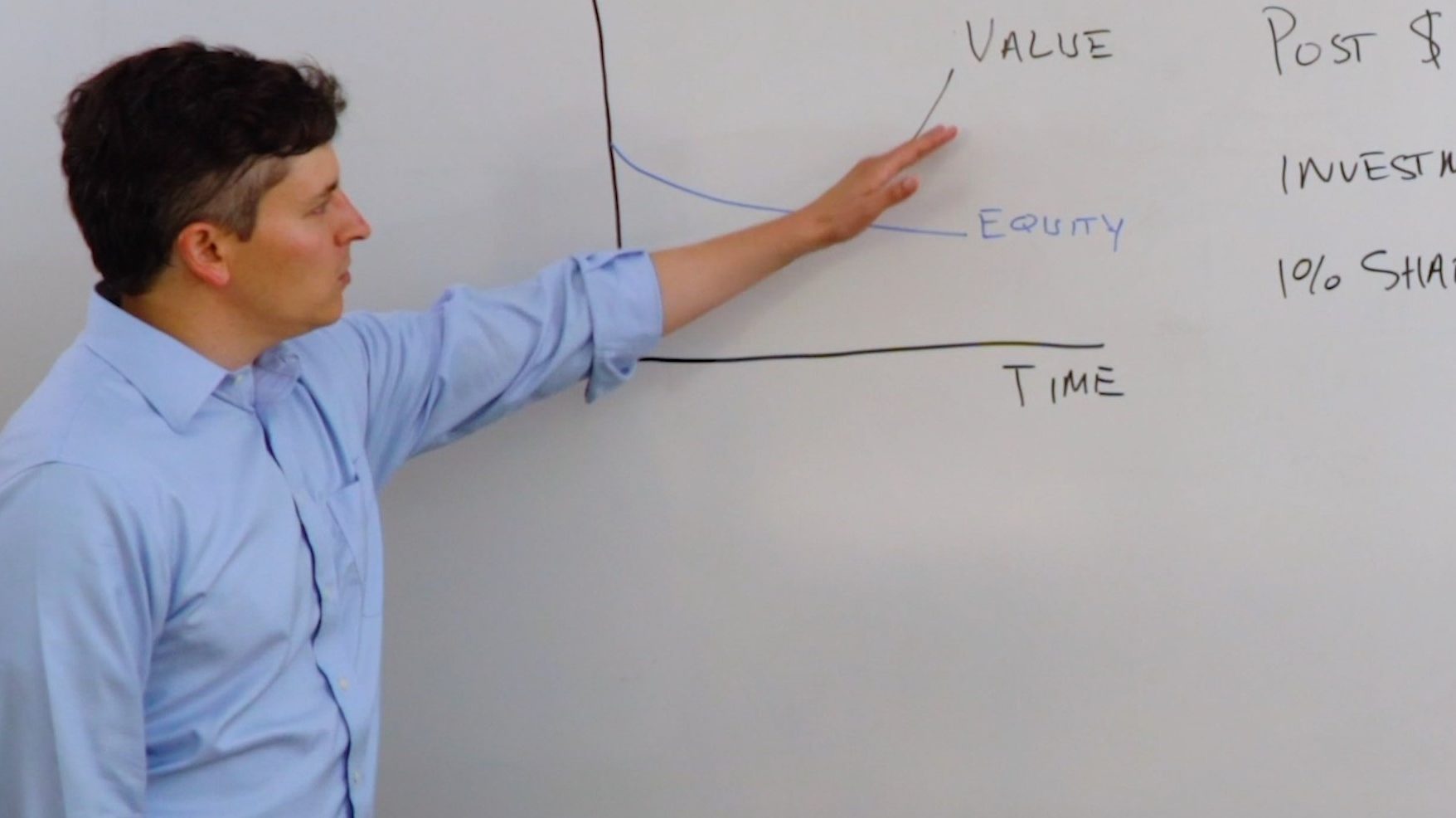

The Race between Value Creation & Equity Dilution

The value of even a small percentage of equity at a startup can increase dramatically over time—if the company successfully exits. But before that happens, the initial percentage of your equity will likely decline.

In order to scale —to really become a rocketship—most founders need to raise outside capital from investors who expect equity shares in return for their money. Each time outside money goes into the business, the percentage of equity you have becomes diluted. You still own the same number of shares, but because the total number of shares has increased, your percentage of equity decreases.

Outside Investment & Dilution

The amount of outside investment the startup raises determines the extent to which your equity will get diluted. If the startup is asset-light and has positive cash flow from the beginning, they may not need to raise much outside capital which would minimize your dilution. But most startups that aspire to scale rapidly will need to raise money. Stanton walks us through the process of determining how dilution will affect the value of your shares over three rounds of investment.

General Dilution Per Round

Data suggests that “after every round of capital that you raise . . . . your equity will be diluted by about 25% per round.” However, Stanton emphasizes, variables, such as the “individual business model or individual capital needs” can influence that generalization.

A good rule of thumb is that after every round of capital that you raise . . . . your equity will be diluted by about 25% per round

Chris Stanton

Dilution from Seed to Series B

Imagine that, in the seed round, the startup’s post-money valuation is $10 million and you were offered a 10% share. After a $2.5 million dollar investment, your original 10% share dilutes to 7.5% of the total outstanding equity in the firm.

Next, the company raises $5 million in a Series A round. Investors determine that the post-money valuation—after their $5 million investment—is $25 million. The overall valuation of the company has increased. But accepting the Series A investment dilutes your share again—from 7.25% to 5.25% of the total equity in the startup.

The same process occurs in Series B, where a $25 million of investment at a $100 million post-money valuation decreases your percentage of the totalequity to about 4%.

Probability—of Success and Failure

Probability—of Success and Failure

Research shows that of startups that raise seed money, the majority—roughly 70%—will fail to make it to the next round. What does the probability of success mean in terms of valuing your equity? After analyzing data, Stanton established a benchmark to illustrate what the distribution of outcomes would look like.

Distribution of Outcomes

He explains, “If we start with 100 startups that receive seed funding, about eight of these firms will exit after a seed round. And those exits tend to have relatively small valuations. On average, about 70% of the ventures that started off within the seed round will exit at zero. Of the 100 startups, approximately 40 firms will go on to raise Series A and 25 firms will make it all the way to series B.”

If a hundred firms receive seed money, fewer than ten of these hundred firms will exit at the seed round above the value of the capital that is invested—so about eight total firms will exit. And those exits tend to have relatively small valuations.

Chris Stanton

Declining Chances of Reaching an Exit Event

Of the 40 startups that survived and got Series A funding, Stanton’s data suggests that only about four will have a successful exit after Series A and 25 will survive to raise series B investment. Of these 25 companies, about three will have a successful exit at that stage and the remaining will either die or raise future investment.

Of the 40 startups that survived and raised a Series A, about four will exit and 25 will continue on to raise a Series B. Of those, only three will exit. The rest will either die or raise future investment.

If the startup doesn’t make it to another round of financing, typically, that means that your equity goes to zero. Stanton stresses that the data offers a generalization and cannot predict the probability of success for any individual startup. But probability weighting can help you determine the expected value of the equity that you started with.

Time to Reach an Exit Event

Time to Reach an Exit Event

Considering the time between first receiving an equity grant and a future exit event can also help you assign some value to your percentage of equity shares. The present value of money, Stanton notes, is greater than the value of money in the future—especially when that future may not materialize. The equity offer you have may look valuable on paper but, you won’t be able to realize the value of that equity until an exit event occurs.

Period of Illiquidity

Often, a Series B investment may not occur for three to five years after you’re initially granted equity. During that time—a period of illiquidity—you won’t be able to access the value of that capital. Stanton explains, “Equity tends to be an illiquid position, meaning that we need some type of exit or some type of event to allow the entrepreneur or the joiner to cash out. And the amount of time between seed series A and series B helps to determine what the value of the shares might be.”

On average, it takes most startups seven to eight years to exit or reach a liquidity event—the point at which you can cash out or access the value of your equity.

Combining the 3 Factors to Understand the Real Value of Your Equity

Suppose that the founder, when he offered you a 10% equity share, forecast, “This company is going to be worth $100 million.” Having 10% of $100 million sounds appealing. How will three rounds of investment affect that number?

Factoring in dilution, a 10% share of total equity drops to 4%—$4 million of $100 million. Once you factor in a 25% probability of success, the percentage of equity you own drops again, from 4% to 1%, making your share of a $100 million worth about $1 million.

Additionally, of the 25% of startups that make it to Series B, only three will actually exit there. Considering dilution, probability of success, and time to exit together, the equity value in this example drops to somewhere around half a million dollars.

Inferences Based on Averages

- The initial equity percentage that you started with will drop—by roughly half—after raising capital

- You have a 25% probability of getting paid your equity

- You will likely not be able to access the value of your equity shares for seven to eight years

The 10% Rule

This gives rise to what Stanton dubs the 10% rule. He explains, “Take the original equity that you were offered, use the probability of success and the dilution, and you can, as a rough benchmark, multiply your likely exit by 10% of your original stake to give you some value in the firm.”

Applying that rule—factoring in your dilution rate and the time it could take to see the money in the future—can give you a ballpark sense of what that equity might be worth.

When a founder offers you 10% of the early-stage equity, you need to take into account that the equity is going to be less than 10% of what was promised after outside investors take a piece of the firm.

Chris Stanton

At the end of the day, to get a sizeable amount of money for your equity shares, Stanton concludes, either the company needs to hit a billion-dollar+ exit or you need to have retained a significant percentage of equity until the successful exit event. “These exits won’t be realized for seven to eight years,” he notes, “so you may want to discount that future event to the present.”

Value Increases over Time

Giving the reality of dilution and probability of failure, is joining a startup worth it? Quite possibly. Stanton and Ghosh would advise you to consider the specifics of the equity offer extended to you in light of the 10% rule. Each time the startup raises outside funding, your percentage of equity is diluted. However, it’s important to remember that successfully reaching a new round, typically signals that the entire equity pie is growing larger—and the startup is becoming more valuable.

Using the above example, the startup’s total valuation grew from $10 million at pre-seed to $100 million after Series B. While the percentage of equity you own shrinks with each round of investment, having a small percentage of equity at a high valuation may offset the amount you were diluted. The core question to consider when applying the 10% rule: Will the value of your shares increase over time? If so, by how much? Get more tips for valuing your equity over time and tell if the startup you’re joining could be a rocketship below.

Joining a startup “is riskier than taking a straight salary. [But] depending on your expectations, it might be worth it to forgo something for the value of this equity [in roughly] eight years down the line.

Chris Stanton

Questions to Consider

- How long does is it going to take before an exit?

- How much capital is the firm going to need to raise?

- What is the probability of success or failure for this venture?

- Is startup going to be very risky but have a huge outcome potential? Or is this going to be a safer firm, but where an intermediate outcome is more likely?

EXPLORE MORE

“How to Tell If You’re Joining a Rocketship” Angelist shares a list of questions they compiled to help you evaluate “rocketship signals,” including the startup’s VC activity, its finances, and the talent they’ve attracted. Equally important is your belief in the vision.

In “Valuing Employee Equity at Early Stage Ventures” Chris Stanton, Shikhar Ghosh, and Sanchali Pal provide an in-depth review of a framework Stanton discusses in this post using a fictional example of a recent HBS graduate who makes a compensation comparison (combined salary and equity) between a startup and consulting firm. It illustrates how to factor in pre-money valuations in each round, dilution based on the amount raised, and the probability of success/failure at each stage.

“Dilution 101: A Startup Guide to Equity Dilution with Real-World Statistics,” by Morgan Stanely’s Shareworks examines “the equity equation”—exploring why founders would choose to dilute, sources of dilution, an equity dilution calculator, a waterfall analysis and dilution, and dilution norms and benchmarks.