Co-Founder Equity Splits—Ways to Approach Allocations

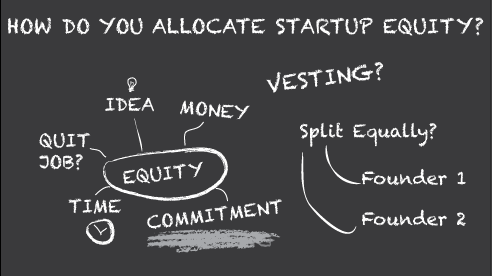

Deciding how to allocate equity is one of the leading sources of founder conflict. Harvard Business Review found that the percentage of founders who express unhappiness with their equity split increases 2.5x as their startups mature. What are the most common mistakes founders make when dividing equity and how can you avoid them? Before you begin discussing how big each founder’s slice should be, understand the conceptual factors that shape an equity split. Serial founder, advisor, and investor Shikhar Ghosh reviews common ways to divide equity and the insights he learned as a Professor of Management Practice at HBS. In a conversation with serial entrepreneur and CEO Lara Hodgson and founder and CEO Rajesh Yabaji about their experiences allocating equity. They share tips for how to think about equity splits in a way that will improve your chances of long-term satisfaction. Many ways to calculate equity splits exist. But three common theoretical approaches form the basis of most divisions.

How to Think about Equity Splits—3 Common Practices for Allocating Co-Founder Equity

- Equal Division of Equity

- Transactional Approach to Dividing Equity

- Relational Approach to Dividing Equity

Equal Division of Equity

Equal Division of Equity

Popular resources for entrepreneurs debate the general merits of equal equity splits vs. unequal divisions. According to Y Combinator co-founder Paul Graham, about 20% of their startups resulted in a founder leaving. Often, the conflict stems from equity splits.

Benefits of Equal Splits

To avoid future conflict, many founders opt to divide funder equity equally among partners. Some experts, like Michael Seibel, CEO of Y Combinator’s accelerator program, endorse dividing equity equally at the outset. Advocates of equal splits charge that assigning a low percentage share to a partner signals that you don’t value that partner. And that can harm your relationship. So some conclude that dividing equity equally can strengthen the relationship between co-founders

Drawbacks of Equal Splits

On the other hand, Chris Dixon, co-founder of Founder Collective, cautions that equal splits can lead to future problems. He observes, “people tend to overvalue past contributions (coming up with the idea, spending time developing it, building a prototype, etc.) and undervalue future contributions.” Plus, over time, one co-founder may contribute less or become less committed. And that can provoke bitterness between partners.

Impact of Equal Splits on Funding

How you split equity affects more than your relationship with your co-founder. It could limit your funding options. For instance, before deciding to invest, VCs often look at founder equity splits as an indication of the founding team’s value and cohesiveness. Experts like Mark Suster and Noam Wasserman, warn that 50/50 equity splits can raise a red flag to investors. An equal split could indicate a CEO’s inability to negotiate or manage difficult issues. In some cases, this could cause VCs to withhold funding.

Why? Investors look for founders and CEOs with strong leadership skills, who can engage in and resolve difficult conversations. Because deciding how to split equity typifies a difficult conversation, it gives investors an important indication of the future CEO’s leadership and judgment. Additionally, some VCs frown on splits or grunt funds that propose an ever-changing founder equity split.

Before Dividing Equity, Define What You Value

Before you can decide how to divide equity, you must agree on what you value, as individuals and as a company. Lara Hodgson, who co-founded Nourish (2009) and NOW Corporation (2010), notes, the first challenge is deciding with your partners, “what are you even valuing? It’s hard to say, ‘what is the value of the idea?’ Because there isn’t a value to it.”

What is the value to the actual creation and implementation of an idea? How do you value those differently?

Lara Hodgson

Agreeing on What to Value

Value is subjective. It’s imperative to discuss what you value with your co-founders to ascertain if your expectations align. For some people, time represents a primary unit of value. Hodgson recommends sitting with partners to define what each person’s unit of value is. “One of the challenges I’ve had,” she shares, is that a co-founder’s background and experience “dictates how they view their value.”

For instance, one person may believe that working three hours on a particular task means she added X value. For others, a unit of time holds little or no worth if it doesn’t produce results. “As someone that comes from an entrepreneurial background, a unit of time is not worth a dollar to me” without results. She adds, “I’m always looking at what result—what asset—has been created from which I can derive future dollars.”

As an entrepreneur, I’m always looking at what result—what asset—has been created from which I can derive future dollars. Because that is a unit of value.

Lara Hodgson

Transactional Approach to Dividing Equity

Transactional Approach to Dividing Equity

Co-founders contribute time, money, ideas, relationships, supplies, equipment, and other assets. A transactional model lists the various assets each person brings to the venture. Then, after assigning value to each asset, you divide equity accordingly. Questions like, “What do I get in return for what I am putting in?” form the basis of the transactional model.

Assigning Weighted Value to Assets

Co-founders following a transactional approach would assign a weighted value to assets, including:

- Intellectual property (IP): “this idea was yours, that idea was mine”

- Financial input: “I’m putting in $100K and you’re putting in $50K.”

- Time: “I’m working on this project full-time, whereas you retained your full-time job.”

Studies show that, in general, teams that take a longer time to negotiate are more likely to follow a transactional approach and divide equity unequally.

Benefits—When Transactional Works

If co-founders discuss expectations and agree on what contributions they value, a transactional approach can work. For instance, take a scenario where 2 co-founders agree not to raise outside funding. Both spend 100% of their time on the venture and bring equally valuable skill sets to the table. They agree that the amount of capital that each invests in the venture will account for 50% of the equity split and they will divide the other 50% equally. Co-founder A contributes ¾ of the funds and co-founder contributes ¼. Following the transactional approach, the team agrees that co-founder A should receive 25%, plus ¾ of the remaining equity, for a total of 62.5% of the equity, with 37.5% going to co-founder B.

Drawbacks—What Could Go Wrong?

Assigning a tangible value to an idea, time, and connections proves tricky. You can get easily derailed by conflicting advice or mired in the formulas designed to help you calculate unequal splits. And while having a formula may seem helpful, to arrive at an answer, you must speculate—without any context—your company’s current and future value.

Often, people tend to place more value on contributions made in the early stages. However, contributions aren’t static. One co-founder may spend less time on the company but contribute IP that is invaluable. How will you think about similar issues that will inevitably arise?

Relational Approach of Dividing Equity

Relational Approach of Dividing Equity

A relational model is the most common approach to equity.

Assigning Equal Value to All

Co-founders adopting a relational approach operate under the assumption that all co-founders are equally invested in the outcome of the venture. Adopting a relational approach to dividing co-founder equity:

- Disregards individual contributions

- Divides equity equally among co-founders since contributions are considered to have the same value

Thus, it doesn’t matter who does how much. Many believe that an equal split signifies fairness for all and the majority of founders begin with 50/50 equity splits.

Benefits—When It Works

If co-founders thoroughly discuss expectations, a relational approach can work seamlessly. For instance, three co-founders launched BlackBuck, a technological platform and network that revolutionized India’s trucking industry, in 2015. Each had different levels of experience. Plus one made a significant financial investment, whereas the other 2 intended to contribute more time. However, the three partners carefully discussed expectations. They unanimously agreed that, despite their different contributions, they shared the same dedication to the startup. To reflect their values alignment and the co-founder relationship he wanted to create, co-founder and CEO Rajesh Yabaji decided to divide equity equally with his partners.

Money was never the core motivation starting. The core motivation was making a large-scale impact. And anything which sub-optimizes this large-scale impact, any of these situations—unequal pledge, positioning, who’s doing what—that brings in politics and division.

Rajesh Yabaji

For BlackBuck to succeed and grow into a unicorn, Yabaji, reasoned, they needed to establish a structure in which each co-founder felt completely committed to the future of the company with no distractions. “If we achieved our vision, the equity share would not matter. If we failed, the share would not matter either.”

But if co-founders haven’t invested the time in getting to know one another, in both personal and professional settings, their expectations may be misaligned. And jumping into a 50-50 equity split may have dire consequences.

Drawbacks—What Could Go Wrong?

Robin Chase, co-founder of Zipcar, a car-sharing company, learned this the hard way. She felt eager to form a business with Antje Danielson, another mom she chatted with at the playground. Hoping to avoid a lengthy discussion over founder equity that could derail the business, she proposed a 50/50 split at their very first business meeting.

But as Zipcar started to stabilize, the co-founders’ relationship grew strained. From the outset, Chase devoted herself to the venture full-time, while Danielson retained her job as a Harvard professor and contributed as she could. Because she devoted considerably more time to the business, Chase felt that she deserved more assets and more power. Ultimately, their conflict and power struggles caused both founders to leave Zipcar before seeing their shared vision through.

Philosophical Considerations

- Long term effects. Before dividing equity, talk with your co-founder about the long terms implications of allocating equity.

- Culture and beliefs. Both relational and transactional frameworks for approaching equity work. Choose which fits your personal beliefs and matches the company culture you want to create.

- Overcoming future challenges. Create a plan to help you discuss your individual relationship to the value the team must create as a whole, and the skills and resources you need to overcome future challenges.

More Than a Financial Decision

People commonly associate their portion of equity with financial value. But how you divide equity is more than a financial decision. Your choice on how to split equity communicates a great deal of information to everyone—your partners, your team, and your investors—involved with your startup. First, your equity division sends a signal to your team about how you value your partners. In a sense, an equity split embodies your personal and company values. VCs often look at equity splits to get a sense of the founding team’s dynamics. So, how you structure your equity split could affect your funding source.

When Should You Divide Equity?

Some founders allocate equity percentages, for instance, 50/50 or 40/60, once—at the outset of their venture. Those persist over the company’s lifespan. Others decide to accrue equity by following complicated formulas that assign value to individual contributions. These can change monthly and can quickly become unwieldy.

Hodgson and her partners adopted a hybrid approach, based on recognizing new value as its created. She explains, “We started with a base that was well-defined. Then from there, it’s been fluid as people have brought more or less relative value on top of that.”

Summary

- Consider your values and the type of relationship you want to cultivate with your co-founder. How you allocate equity impacts your co-founder relationship.

- How you choose to divide founder equity influences how investors assess your startup.

- Assigning value is subjective and complicated. Start thinking about this early and have ongoing conversations with your co-founders.

EXPLORE MORE

We recommend the following sources on dividing equity.

- “The Co-Founder Mythology” by Mark Suster cautions against forming 50/50 partnerships which he believes are inherently unstable. He advocates shunning convention and hiring a co-founder and offering 20% or 30% equity—not 50%.

- In “How to Split Equity Among Co-Founders,” Michael Seibel, CEO of Y Combinator, reviews and refutes the reasons many experts cite for dividing equity unequally. Explaining why founders should split 50/50, he explains, “If you aren’t willing to give your partner an equal share, then perhaps you are choosing the wrong partner.”

- “Dividing Equity Among Founders,” by Chris Dixon, co-founder of Founder Collective, underscores that no formula exists for dividing equity. He encourages founders to take time to thoroughly assess their individual contributions instead of opting to split equally. Noting that founders tend to overvalue past contributions and undervalue future contributions, he cautions, “Remember that an equity grant is typically for the next 4 years of work (hence 4 years of vesting). Imagine yourself 2 years from now after working day and night, and ask yourself in that situation if the split still seems fair.” Then, he provides guidelines on assessing different contributions.

- In “Splitting Founder Equity: Avoid “Grunt Funds,” Silicon Hills Lawyer, a Texas startup lawyer who helps startups outside of Silicon Valley navigate legalese, cautions founders not to be too flexible in establishing equity. He sharply criticizes the trend of “Grunt Funds,” a method in which founders calculate their equity monthly, by applying a complex formula. He stresses that founders’ agreements should rely on a vesting schedule to adapt to unknowns.